With the rise of digital marketing and social media successes within the advisory landscape, many financial advisors are changing their strategy when it comes to marketing and client relationships. Social advisors – that is, financial advisors who utilize social media – have seen their books grow by utilizing platforms such as Facebook, Twitter, Instagram and LinkedIn.

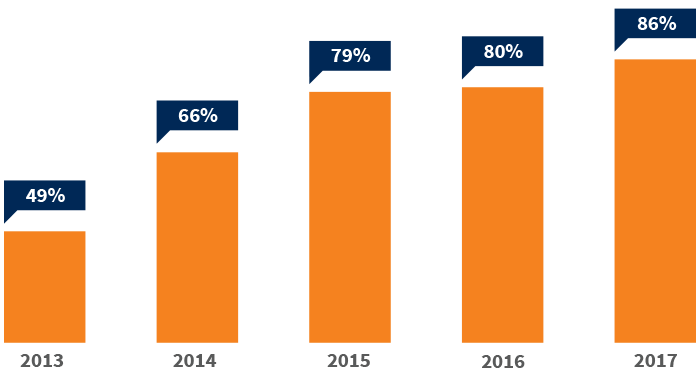

The graph below illustrates the percentage of advisors who have reported that social media activity helped them gain new clients (according to a study from Putnam).

In 2017 alone, 85% of financial advisors surveyed use social media for business. Additionally, of the advisors who used social media, they gained new clients resulting in nearly $5 million in average asset gain. It’s also important to note that 85% also said that social media shortened the selling cycle.

2018 also experienced trends that changed the landscape. Due to the advent of “fake news”, brand trust was hit by a steep decline and many firms needed to explore new opportunities to earn trust back from customers. The solution resulted in larger investment firms creating a new style of “social leadership” where executives became more of an independent, personal brand that represented the firm. This top-down social leadership style trickled downwards onto other managers who started becoming more active on social media. By empowering leadership teams to build up trust and authority, all under their firm’s name, they were able improve trust and cultivate a larger online audience.

Larger investment firms weren’t the only organizations to empower social advisors. RIAs and smaller firms also started shifting their focus to more personal branding efforts to build trust and create online conversations.

As more advisors continue to see success from social marketing, the number of social advisors could rise significantly over the next year. Additionally, with trust being more important now than ever, clients are coming to expect a more meaningful relationship – both online and offline – which can be achieved through social platforms.

Interested in improving or adapting your strategy to become a social advisor? Forbes published an article that provides 15 tips on becoming a social advisor. We’ve outlined some of them here, however this link contains the full list of tips.

Company Social Media Policy. Many firms understand the need to create and implement a flexible social media policy that allows the use of social media and meets the compliance requirements. If a policy doesn’t exist, one should be created. Once a policy has been created, social advisors should review this to find out ways to connect with their clients and prospects online while following the policy.

Define and create your personal brand. Many social advisors stumble into the pitfall of pushing content without defining a strategy for their personal brand. This results in a series of mixed messages that often pushes their audience away, instead of pulling them in. To avoid this pitfall, define what type of content you want to publish, the voice you want to have, and how you plan on engaging with your audience.

Social media is a great resource for listening and prospecting. LinkedIn is a great resource for maintaining relationships and building new ones. Depending on the membership level, you can perform advanced searches that target connections based on specific customer profiles. Additionally, LinkedIn provides opportunities to enhance your personal brand by sharing multimedia content that helps demonstrate expertise and build trust.

Parts of this post include curated content from Concured.com, Hootsuite, Investmentnews.com, and Putnam.com. Links can be found below.

- https://www.concured.com/blog/how-are-financial-institutions-on-instagram-successfully-using-the-channel

- https://www.investmentnews.com/article/20180324/FREE/180329960/social-media-all-stars-of-the-financial-advice-community

- https://www.putnam.com/advisor/business-building/social-media/?van_seg=social

- https://hootsuite.com/resources/2018-social-media-trends-report-for-financial-services

This information is for distribution to institutional clients and is for broker-dealer use only. It is not intended to be distributed to individual retail clients. Any material provided is for information only and is not intended as a recommendation or an offer or solicitation for the purchase or sale of any security or financial instrument.